Hwuason's Latest Masterpiece Legal Practice Of China Difficult Tax Cases (Fifth Edition) Now Available!

Hwuason's Latest Masterpiece Legal Practice Of China Difficult Tax Cases (Fifth Edition) Now Available!

Legal Practice Of China Difficult Tax Cases (Fifth Edition) Now Available!

Recently, the latest monograph Legal Practice Of China Difficult Tax Cases (Fifth Edition), edited by Liu Tianyong, Director of Hwuason Law Firm, has been published and distributed by Law Press!

Based on typical complex tax dispute cases personally handled by Lawyer Liu Tianyong over two decades, Legal Practice Of China Difficult Tax Cases (Fifth Edition) meticulously showcases the expertise and achievements of a seasoned domestic tax lawyer team in resolving specific tax disputes. Since its first publication in 2014, the book has garnered widespread attention and praise from the tax law practice community, with revised editions released in 2016, 2018, and 2021.

In recent years, as China’s tax legislation process has steadily advanced, reforms in the fiscal and taxation systems and tax collection and management around the development of smart taxation have deepened. The concepts of tax compliance and tax adherence have been thoroughly implemented across society, leading to significant changes in the types and industry distribution of typical tax dispute cases, as well as in tax judicial practices. In early 2025, in response to invitations from Law Press and calls from readers, Lawyer Liu Tianyong led the Hwuason team in a comprehensive revision of the book, which took nearly a year to complete, resulting in this fifth edition.

Legal Practice Of China Difficult Tax Cases (Fifth Edition) includes 38 typical tax dispute cases. This edition incorporates the latest tax laws, regulations, policies, and judicial interpretations from the Supreme People’s Court and Supreme People’s Procuratorate to provide actionable and replicable solutions for categorized tax disputes and tax-related criminal cases, significantly enhancing the book’s timeliness and practical value.

Three Major Revision Highlights

Significant Structural Adjustments

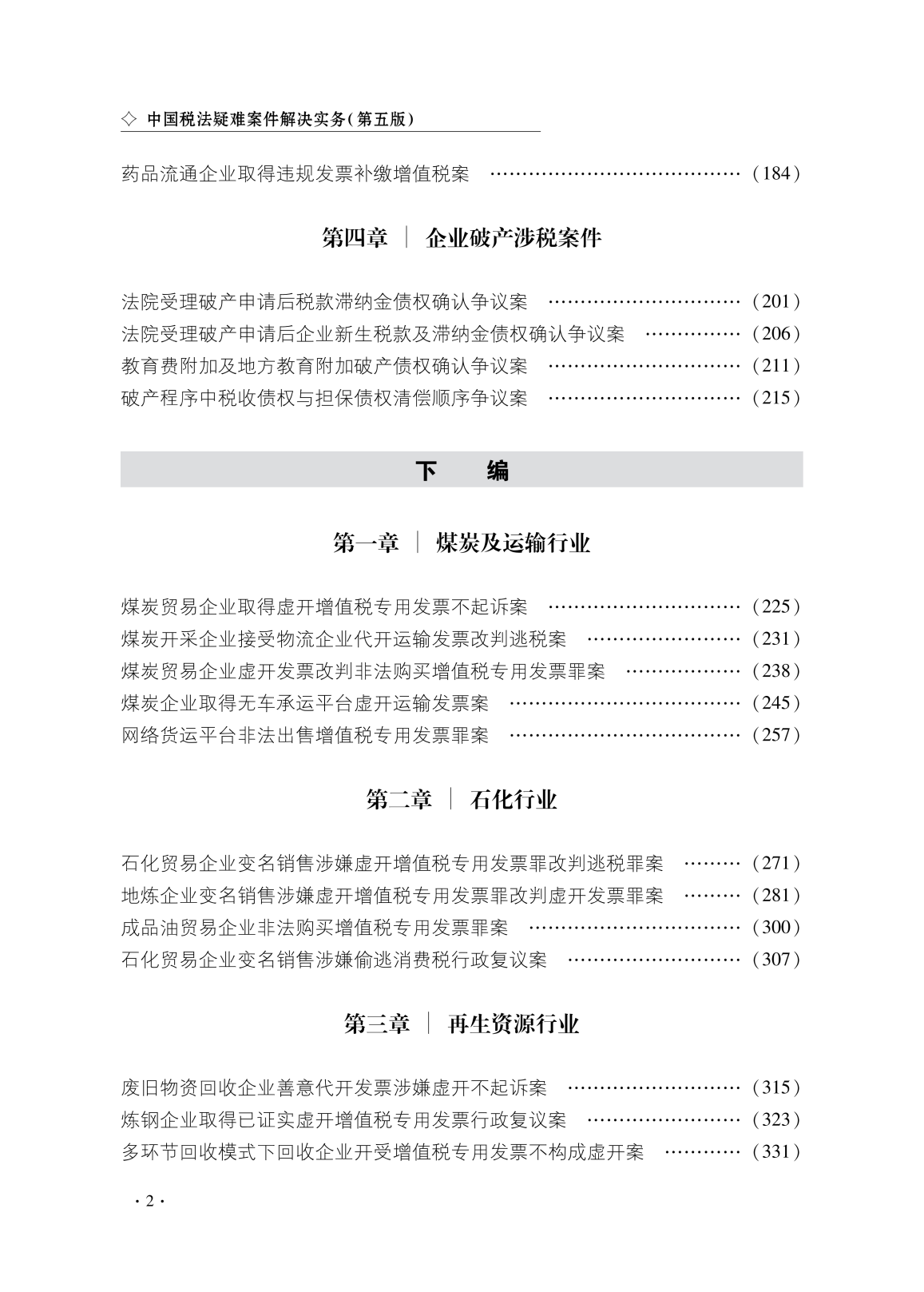

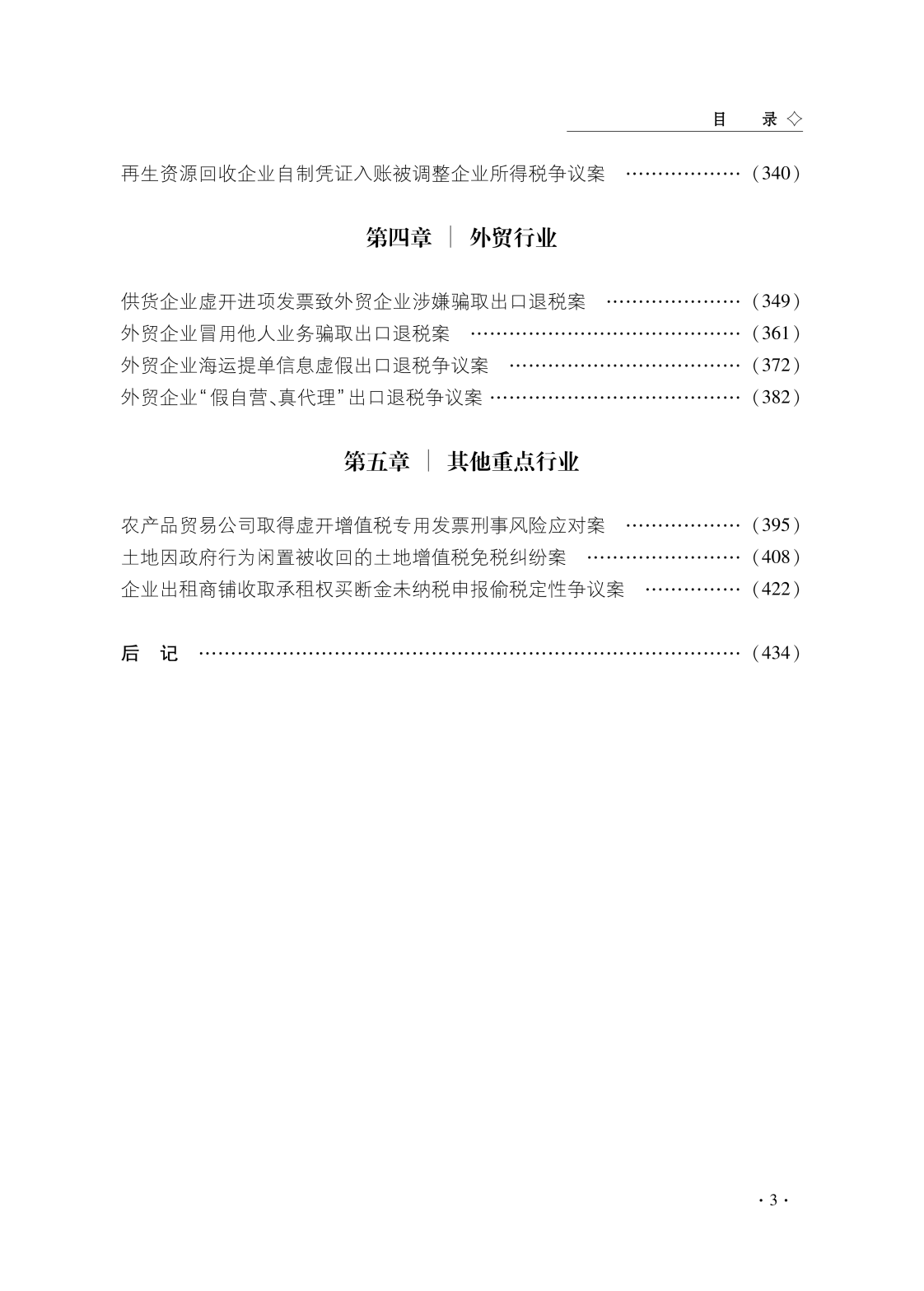

The compilation structure of Legal Practice Of China Difficult Tax Cases (Fifth Edition) has been completely revamped. The book is divided into two parts: the first part focuses on key tax categories, with four chapters covering Corporate Income Tax Cases, Individual Income Tax Cases, Value-Added Tax Cases, and Tax Issues in Corporate Bankruptcy. The second part focuses on high-risk industries, with five chapters addressing sectors such as coal, logistics, petrochemicals, renewable resources, foreign trade, real estate, agricultural products, and tax intermediaries. It not only analyzes relevant cases and dispute resolution strategies but also reveals the latest trends and changes in tax risks within these industries.

Substantial Case Updates

Legal Practice Of China Difficult Tax Cases (Fifth Edition) retains only a small portion of cases from the fourth edition and adds 19 new typical cases handled by the Huashui team in the past three years. These include two new Corporate Income Tax cases, two new Individual Income Tax cases, four new cases on tax issues in corporate bankruptcy, three new cases in foreign trade, two new cases in the petrochemical industry, two new cases in renewable resources and steel, two new cases in real estate, and one new case each in the coal and agricultural products industries.

Alignment with Practical Trends

The new cases in Legal Practice Of China Difficult Tax Cases (Fifth Edition) reflect current trends and hot topics in tax collection and management. These include tax compliance for overseas income of domestic individuals and enterprises (e.g., CRS tax recovery cases, tax information exchange cases), tax incentive compliance for venture capital enterprises, cases involving "invoice-issuing economy" platforms, and tax-related cases related to investment promotion fiscal subsidies. For tax-related criminal cases such as false invoicing, the book incorporates the latest judicial interpretations and guiding cases from the Supreme People’s Court and Supreme People’s Procuratorate. It also includes recent tax-related criminal cases handled by the Huashui lawyer team, highlighting the impact of new judicial interpretations on tax-related criminal judicial practices and the evolving trends in corporate tax-related criminal risks.

Editor

Liu Tianyong, founder of Hwuason and Director of Beijing Hwuason Law Firm, is a seasoned tax lawyer with a Doctor of Law degree and a postdoctoral degree in Economics. He is among the "First Batch of National Tax Leadership Talents" designated by the State Taxation Administration and a legal expert in the Ministry of Finance’s fiscal talent pool. He also serves as the Director of the Finance and Tax Law Professional Committee of the All China Lawyers Association, a member of the Expert Committee for Civil and Administrative Litigation Supervision Cases of the Supreme People’s Procuratorate, and a member of the Expert Committee for Regulatory Review of the Ministry of Justice. Additionally, he holds adjunct professor positions at Peking University, Renmin University of China, China University of Political Science and Law, and other institutions. He has frequently been invited by central authorities such as the Legislative Affairs Commission of the National People’s Congress, the State Council, the Ministry of Justice, the Ministry of Finance, and the State Taxation Administration to participate in legislative and revision discussions for draft laws including the Tax Collection and Administration Law, Individual Income Tax Law, Corporate Income Tax Law, Value-Added Tax Law, and Consumption Tax Law. Over the years, he has successfully represented over 200 high-impact tax-related criminal and administrative cases.

Preface and Table of Contents

Ordering

Legal Practice Of China Difficult Tax Cases (Fifth Edition) is priced at 99 yuan. Purchase it on Law Press China’s official WeChat flagship store "Lawyer" to enjoy a limited-time 25% discount (with free shipping). Readers are welcome to scan the QR code below to place an order.