Online registration: "2024 China Tax &Legal Service Conference" on December 8th in Beijing

The "2024 China Tax &Legal Service Conference " will be held on December 8th in Beijing. The conference will invite experts from relevant departments such as legislative departments, financial departments, tax department, judicial organs, industry associations, famous scholars from academic institutions such as Peking University and China University of Political Science and Law, as well as renowned tax lawyers and tax accountants to attend the conference to discuss the topics of "Deepening the Reform of the Fiscal and Taxation System and Fully Implementing the Principle of Taxation Statute", "Taxation by Numbers and Upgrading Tax-related Services", "Judicial Interpretation of the Two High Commissions and Tax-related Dispute Resolution", "New International Tax Rules and Tax Management of Investment and Financing", "New International Tax Rules and Tax Management of Investment and Financing", "Innovation and Upgrading of Tax Legal Services in China" and other topics. The purpose of holding this conference is to deeply implement the spirit of the 20th CPC National Congress and the decision of the 3rd Plenary Session of the 20th CPC Central Committee, deepen the new round of reform of the fiscal and taxation system, promote the fiscal and taxation system to be more mature and shaped, give full play to the role of fiscal and taxation as the foundation, pillar and safeguard of the national governance, analyse and discuss the new dynamics of the current tax-related services, new business and hot and difficult issues, and continuously lead the development of the tax legal services industry in China , business innovation and strategic cooperation.

The following is the notice of the meeting.

I. Time and place

Time: Sunday, 8 December 2024, 1 day

Venue: Beijing - Jing Yi Hotel

II. Theme of the meeting

Chinese-style modernisation and upgrading of tax-related services

III. Participants

Tax lawyers, certified public accountants, tax cadres, judges, prosecutors, university scholars, postgraduate students, enterprise finance and tax personnel and other types of tax-related people.

IV. Related requirements

The exchange will be free to attend and no information or conference fee will be charged. Due to limited space, all proposed participants need to submit the registration form on time and attend the meeting after confirmation by the organising committee.

V. Enrolment

1)Email registration: taxlawyer2015@126.com (registration form submission deadline is up to 2 December 2024), participants will only be allowed to attend if the organising committee confirms that a formal invitation letter has been issued.

Contact: Jian Li (18601356040)

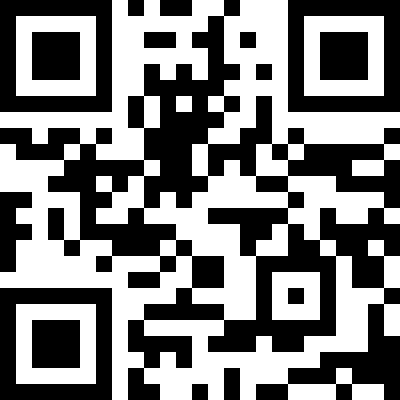

(2) Express registration channel: long press to identify the following QR code to jump to the registration interface, online submission of registration.

Annex 1: Agenda

2024 China Tax& Legal Service Business Conference

|

Sunday, 8 December 2024 |

||

|

Serial Number |

Time |

Theme |

|

1 |

7:45-8:30 |

Sign in |

|

2 |

8:30-8:45 |

Opening Ceremony (Guests of Honour) Wang Qingyou (Vice President, All China Lawyers Association) Liu Jianwen (President of the Research Society of Finance and Taxation Law of the China Law Society and Professor of the Law School of Peking University) Shi Zhengwen (Professor and Director of the Research Centre for Finance and Taxation Law, China University of Political Science and Law) Moderator: Liu Tianyong (Director of the Professional Committee on Finance and Taxation Law of the National Lawyers' Association and Director of Beijing Huatax Law Firm) |

|

3 |

8:45-10:30 |

Theme 1: Deepening the Reform of the Fiscal System and Fully Implementing the Principle of Legal Taxation Selected Issues in Tax Law Reform and Development (Senior Tax Expert) Analysis of Hot Issues in the Revision of the Tax Administration Law (Shi Zhengwen, Director and Professor of the Research Centre for Fiscal and Tax Law, China University of Political Science and Law, and Vice Chairman of the Fiscal and Tax Law Research Society of the China Law Society) Latest Progress on VAT Reform and Legislation (Ye Shan, Professor, School of Law, Peking University, and Director, Peking University Finance and Tax Law Research Centre) Moderator: Lu Yi (Deputy Director of the Professional Committee on Finance and Taxation Law of the National Lawyers Association, Partner of Beijing Guofeng (Shanghai) Law Firm) Commentator: Weng Wuyao (Professor and Doctoral Supervisor, China University of Political Science and Law; Director, Institute of Taxation and Financial Law, China University of Political Science and Law) |

|

4 |

10:30-10:40 |

Rest |

|

5 |

10:40-12:00 |

Theme 2: Tax Rule by Numbers and Upgrading Tax-Related Services

Moderator: Wang Zhaohui (Deputy Director and Secretary General of Finance and Taxation Law Committee of All-China Lawyers' Association, Senior Partner of Beijing Jincheng & Tongda Law Firm) Commentator: Zhu Daqi (Professor, School of Law, Renmin University of China, and Vice President of the Research Society of Finance and Taxation Law, China Law Society) Zhou Xuzhong (Secretary-General of the Research Society of Finance and Taxation Law of the China Law Society and Professor of the Law School of the Capital University of Economics and Business) |

|

6 |

12:00-13:30 |

Lunchtime |

|

7 |

13:30-14:50

|

Topic III: Judicial Interpretations of the Two High Commissions and Tax-Related Dispute Resolution

Moderator: Li Shuqu (Deputy Director of the Professional Committee on Finance and Taxation Law of the National Lawyers Association, Senior Partner of Beijing Yingke Law Firm) Reviewer: Chen Shuangzhuan (Editorial Director, Tax Research) |

|

8 |

14:50-15:00 |

Rest |

|

9 |

15:00-16:20 |

Topic IV: New International Tax Rules and Tax Management of Investment and Financing

Moderator: Zheng Weinan (Deputy Director of the Professional Committee on Finance and Tax Law of the National Lawyers Association, Partner of Investec Republic (Wuhan) Law Firm) Commentator: Sun Hongmei (Director, International Department, Institute of Taxation Science, State Administration of Taxation) |

|

10 |

16:20-17:20 |

Theme 5: Innovation and Upgrading of China's Tax Legal Services

Cai Ming (Deputy Director of the Finance and Taxation Law Committee of the All-China Lawyers' Association, Managing Partner of Guohao Law Firm (Nanchang)) Song Jianhong (Member of the Professional Committee on Finance and Taxation Law of the National Lawyers' Association, Senior Partner of Hebei Sanhe Times Law Firm) Xu Qiping (Member of the Professional Committee of Finance and Taxation Law of the National Lawyers Association, Managing Partner of Zhejiang Zedah Law Firm) Moderator: Ma Xiaoyan (Deputy Director of Finance and Taxation Law Committee of the National Lawyers Association, Senior Partner of Shanghai Jintiancheng (Guangzhou) Law Firm) Commentator: Zhang Qiaozhen (Member of the Professional Committee on Finance and Taxation Law of the National Lawyers' Association, Senior Partner of Shanxi Hua Torch Law Firm) |

|

11 |

17:20-17:30 |

Closing Ceremony (Guest of Honour)

Moderator: Chen Bin (Deputy Director of the Professional Committee of Finance and Taxation Law of the National Lawyers Association and Director of the Management Committee of Beijing Yingke (Nanjing) Law Firm) |

Note: Please note that specific arrangements are subject to change on the day.

Annex 2: Registration Form

Attendance Reply for "2024 China Tax &Legal Service Conference "

|

Name |

|

Sex |

|

|

Work Unit |

|

Position |

|

|

Telephone |

|

Mobile Phone |

|

|

E-Mail Address |

|

||

Note: Please email the RSVP for participation (which can be copied or self-edited) by 2 December 2024 at the latest to: taxlawyer2015@126.com.

Link to China University of Political Science and Law, Centre for Fiscal Law Studies:

https://msjjfxy.cupl.edu.cn/info/1046/9438.htm